Foreword: Gratitude to my Mother

I’m very grateful to my mother for teaching me so much around financial literacy. I think it’s a shame that it’s not taught more, since it can make a huge difference to your short and long term goals, quality of life, and peace of mind. She gave me a platform to build more knowledge on, and I’d like to share some things I’ve either been taught or have picked up over the years.

Basics of Financial Literacy

Handling Spare Money

If you get a windfall or save a good amount every paycheck, you might be wondering what to do with your money.

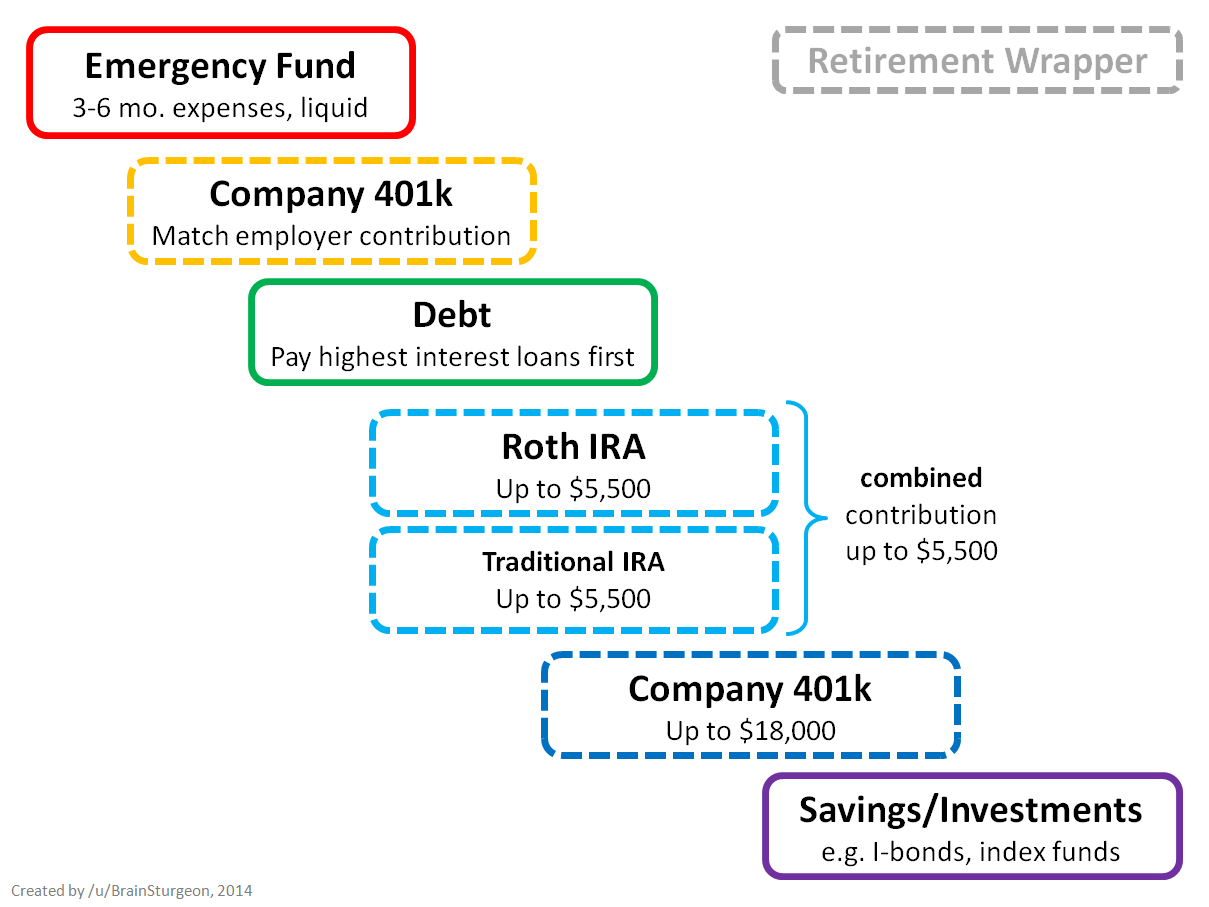

This article does an excellent job indicating priorities, and it even has a diagram showing priorities. As a quick summary, in case you don’t want to click there:

- Emergency fund (3-6 months of expenses, start with 1 month and build up)

- Max out employer match on retirement accounts

- Pay off high interest debt (e.g. credit cards)

- HSA (health savings account, don’t worry about this if your job doesn’t offer it)

- Max out remainder of retirement plan contributions

- Traditional/ROTH IRAsPay off medium interest debt (e.g. car loan)

- Taxable brokerage accounts (“normal stock account”)

- Pay off low interest debt (e.g. mortgage)

Tracking Your Spending

It’s easy to think you know how much you’re spending, but it’s also easy for the small things to snowball and become big.

It’s also easy to forget about things like streaming accounts you’re not using. In fact, there are whole businesses/services dedicated to finding recurring costs you don’t use so they can take a cut of what you save. I don’t like that business model, for what it’s worth.

These days, I use Monarch Money – it’s a user-friendly budgeting, planning, and financial collaboration tool that helps track things over time by category (you can define/override these easily!), plan for major life events (e.g. a wedding), and see trends in spending. I especially appreciate their recurring expenses tracker, which helped me visualize when and how much money is spent on a regular basis.

I personally have also used Buxfer and Mint in the past as well. Intuit (owners of Mint) profits off of analyzing and selling data. Buxfer is a much smaller company dedicated just to this budgeting application. It’s not perfect, but it is powerful, and being able to set budgets, see trends, and see all my account balances in one place is handy in my eyes.

- Buxfer has a powerful demo that lets you actually see how the application works on a mock user. I find their user interface a little clunkier than Monarch, personally.

- As for the security and privacy side of things, Buxfer and Monarch both work with financial connection providers (like Plaid) to give out “tokens” rather than storing credentials themselves, and the tokens issued from my banks are effectively read-only and scoped pretty specifically.

- That makes it so even if they’re hacked and their info decrypted, the hackers will be able to see balances and some transaction info, but that’s the extent of it.

Planning for the Future

Along with tracking spending, being able to forecast, project, and extrapolate financial planning can be very helpful as well. For example, if you know you have a major expense coming up in a few months/years, being able to project how much it will actually impact you can be empowering!

I do this partially via Monarch Money for short-term things and via ProjectionLab for more long-term goals like retirement (someday), a home purchase, or medical expenses in old age. Some notes about ProjectionLab:

- Financial Data: ProjectionLab doesn’t require any real info or financial institution connections, so you can put in spoofed/fake data if you’d prefer.

- Security/Privacy: the information stays in your browser and only your browser unless you buy a license, at which point data is encrypted at rest and in traffic or you can self-host the application.

- Trial: they have a fantastic demo that has some prebuilt models to show you how it can help!

Allocating Money: Housing, Savings, Fun

There’s a classic piece of advice given out: spend no more than 30% on your housing.

I think that’s outdated advice given how much the economy, wages, and housing costs have changed, especially in the last 10 years.

This article gives what I consider a much more reasonable approach, and I highly advise reading it if this is on your mind. That article mentions this near the end, but if you really want a framework with percentages to live by, try the 50/30/20 budget:

Set aside 50% of your take-home pay for rent, utilities, groceries, transportation, insurance, and other living essentials that typically cost the same month to month. Use 30% of your take-home pay on non-essentials, or “wants,” like clothing, dining out, and entertainment. Lastly, use 20% of your monthly income to save.